|

Getting your Trinity Audio player ready...

|

Have you ever felt stuck in a cycle of financial stress, no matter how hard you try to get ahead? The truth is that your beliefs about money shape your financial reality. If you constantly feel like there’s never enough or that money is hard to come by, that mindset could be holding you back.

But don’t worry—there’s good news! You can change your mindset about money and start attracting financial abundance with the right strategies.

Changing how you think about money isn’t about wishful thinking; it’s about shifting your perspective, habits, and actions. If you’ve been looking for ways to transform your relationship with money, you’re in the right place. Here are powerful ways to change your mindset about money and create lasting financial success.

1. Identify Your Money Beliefs

Before you can flip your mindset about money, you’ve gotta figure out where those beliefs came from. Did you grow up hearing “money doesn’t grow on trees” or “rich people are greedy”? Well, surprise—your childhood probably shapes your money mindset, society’s opinion, and your family’s (often questionable) advice.

Take a moment to think: What’s your current relationship with money? Is it your ticket to freedom, or just a stress-inducing headache? Getting real with yourself is the first step to ditching those negative money beliefs.

Read: 8 Spiritual Ways to Get Money

2. Shift from Scarcity to Abundance

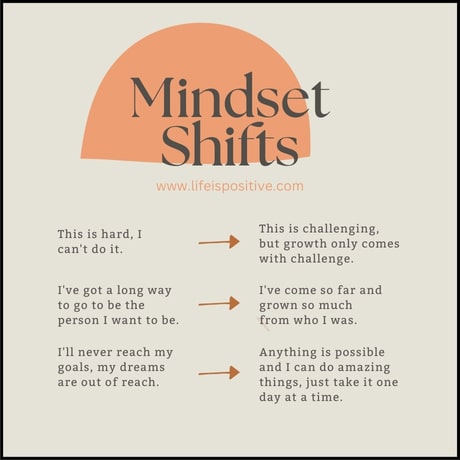

A scarcity mindset has you believing there’s never enough—whether it’s money, opportunities, or success. This can make you act out of fear, like hoarding cash or avoiding investments. But here’s the secret: flip the script and embrace an abundance mindset.

Wealth isn’t some rare gem; it’s all around you, just waiting to be grabbed. Once you start thinking about abundance, you’ll see endless possibilities, not obstacles. Time to stop playing small and start seeing the world as your financial playground!

3. Reframe Negative Money Thoughts

Ever catch yourself saying, “I’m just bad with money” or “I’ll never be rich”? These statements reinforce limiting beliefs and keep you stuck in old patterns.

Try this instead: Replace negative money thoughts with empowering ones. Say, “I am learning to manage my money wisely,” or “Wealth is possible for me.” The more you reinforce positive beliefs, the easier it becomes to change your mindset about money and attract financial success.

4. Educate Yourself on Personal Finance

Knowledge is power—especially when it comes to money. If you’re feeling a bit lost in the finance world, don’t stress. Start small. Read a book, tune into a podcast, or follow some money-savvy experts.

The more you learn, the more you’ll feel like you’ve got your financial life together. And let’s be real, confidence is everything when you’re changing your money mindset and taking charge of your financial future!

5. Set Clear Financial Goals

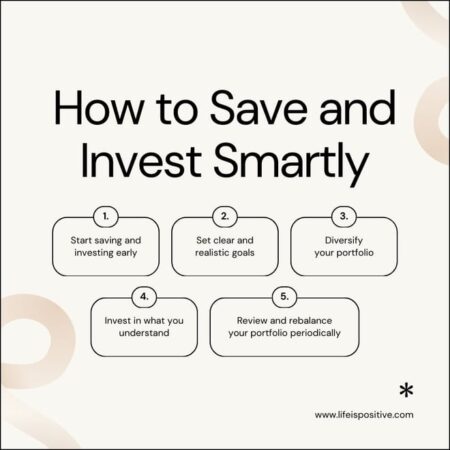

It’s hard to achieve financial success without a clear roadmap. Do you want to pay off debt, build savings, or invest for the future? Get specific about what you want to achieve and set realistic goals.

Having a vision for your financial future helps rewire your brain for success. Every time you hit a milestone, you reinforce your ability to change your mindset about money and keep growing financially.

6. Practice Gratitude for What You Have

It might sound a little cliché, but gratitude can totally flip your money game. Instead of stressing over what you don’t have, start appreciating what you do have. Got a steady job? A roof over your head? Food on the table? That’s plenty to be thankful for!

When you embrace gratitude, you shift your focus from scarcity to abundance. A grateful mindset opens the door to more opportunities. Plus, when you feel good about your money, you’ll naturally start making smarter financial choices, helping you level up your money mindset.

Read: 7 Powerful Steps To Overcoming Money Fear

7. Surround Yourself with Financially Savvy People

The people you hang with can totally affect your mindset—money included. If you’re always surrounded by people who complain about cash or think wealth is for other people, guess what? That mindset might start rubbing off on you.

So, why not switch it up? Hang out with people who have a positive, proactive attitude toward money. Talk investments, savings, and all those smart money moves. Being in a financially empowering circle will make it way easier to shift your money mindset and pick up healthier financial habits.

8. Take Action—Even Small Steps Count

Changing your money mindset isn’t just about thinking differently—it’s about actually doing something about it. Little moves, like creating a budget, setting up automatic savings, or tossing a bit into investments each month, can really add up.

Taking action reminds you that you’ve got the reins when it comes to your financial future. The more you do, the more confident you get, and that makes it way easier to lock in that positive money mindset for good.

9. Visualize Your Financial Success

Visualization is a powerful tool used by successful people in all areas of life. Take a few minutes each day to picture yourself living your financial goals. Imagine paying off debt, growing your savings, or enjoying financial freedom.

When you regularly visualize success, your brain starts aligning your actions with that vision. This practice helps reinforce your efforts to change your mindset about money and stay motivated toward financial growth.

Read: 5 Powerful Ways to Shift Your Money Mindset

10. Be Patient and Stay Consistent

Shifting your money mindset doesn’t happen overnight. Just like any habit, it takes time and consistency. There may be setbacks along the way, but don’t let them discourage you. Keep practicing positive financial habits, learning, and adjusting as needed.

The more you reinforce positive money behaviors, the easier it becomes to change your mindset about money and create lasting financial success.

Final Thoughts: Change Your Mindset About Money

Changing your mindset about money is the ultimate game-changer—it’s what separates the financially stuck from the financially thriving. By switching from a scarcity mindset to one of abundance, taking control of your finances, and embracing smart money habits, you’re setting yourself up for long-term wealth and freedom.

Here’s the thing: Your financial future isn’t written in stone. You’ve got the power to change your money mindset and rewrite the whole story.

Start today. Take one tiny, actionable step—whether it’s setting a budget, investing in yourself, or just believing that financial success is within your reach. The more you reinforce those new beliefs and habits, the easier it becomes to shift your money mindset and start attracting wealth with ease.

Financial freedom isn’t just for the lucky few—it’s for anyone who’s ready to think differently, take action, and stay consistent. So go ahead—claim that abundance, you’ve earned it!

For more empowering content, connect with our vibrant community here ➡️ Social Media.