|

Getting your Trinity Audio player ready...

|

Ever caught yourself wondering, “Am I financially literate?” You’re definitely not the only one.

With everyone talking about budgeting apps, investment portfolios, and crypto trends, it can feel like everyone’s got their financial game on point while you’re still trying to figure out where your paycheck disappeared to last weekend.

But here’s the thing: financial literacy isn’t about being a math genius or mastering Wall Street lingo. It’s all about understanding how to manage, save, and grow your money to support your goals. In other words, when you can confidently say, “I am financially literate,” you’re not just getting by—you’re owning it.

Curious about what financial literacy really means and how you can check your own money smarts? We’re breaking it down so you can go from “Am I financially literate?” to a confident “Yep, I’ve got this!”

What Does It Mean to Be Financially Literate?

First things first—what exactly is financial literacy? In simple terms, it’s your ability to understand and effectively use various financial skills, like budgeting, saving, investing, and managing debt.

Think of it as your money roadmap. Without it, you might find yourself wandering through a maze of confusing credit card bills, surprise expenses, and zero savings. With it, you have the tools to plan for a future that includes more financial freedom and fewer money-induced headaches.

If you can confidently answer questions like, “How much do I spend on necessities each month?” or “What’s my plan for retirement?” then you’re already on your way to being able to say, “I am financially literate.”

Read: 10 Habits of Financially Literate People

Signs You’re Financially Literate

Let’s play a little quiz. Do any of these sound like you?

1. You Have a Budget and Actually Stick to It

Financially literate people know where their money is going. If you’re tracking your income and expenses and sticking to a budget (most of the time), you’re doing something right.

2. You Save for Emergencies

Do you have an emergency fund for those “just in case” moments? If you’ve got at least three to six months of living expenses saved, give yourself a high five.

3. You Understand Debt

Whether it’s a credit card balance or a student loan, financially literate folks know how to manage debt and avoid drowning in interest.

4. You’re Investing in Your Future

If you’re contributing to a retirement account, investing in stocks, or planning for long-term financial growth, you’re already ahead of the game.

Read: 12 Signs You’re Smart

Warning Signs You Might Need a Financial Literacy Boost

On the flip side, there are some red flags that might indicate you need to work on your money skills. Don’t worry—there’s no shame here! The goal is to get you from “Am I financially literate?” to “I am financially literate and loving it!”

1. You Don’t Know Where Your Money Goes

If payday comes and your money disappears faster than you can say “rent is due,” it’s time to track your spending.

2. You’re Drowning in Debt

Credit card balances piling up? Payday loans haunting you? It’s a sign you might need to brush up on debt management strategies.

Read: The Ultimate Guide From Debt to Wealth

3. You’re Not Saving or Investing

Living paycheck to paycheck without setting aside money for the future is a recipe for financial stress.

How to Become Financially Literate

If you’re feeling a little shaky in the financial literacy department, don’t panic. Like any skill, becoming financially literate takes time and practice. Here’s how to get started:

1. Learn the Basics

Start with the ABCs of money management:

- Understand your income and expenses.

- Learn how credit scores work.

- Get familiar with terms like interest rates, inflation, and diversification.

The internet is your friend here. Blogs, podcasts, and free online courses are fantastic resources.

2. Create a Budget

Yes, budgets can feel boring, but they’re your financial BFF. Write down your monthly income and expenses, and figure out how much you can save. Apps like Mint or YNAB (You Need A Budget) can make this process less painful.

3. Pay Down Debt

If debt is weighing you down, tackle it head-on. Focus on paying off high-interest debts first while still making minimum payments on the rest. This strategy, known as the avalanche method, saves you money in the long run.

4. Start Saving Early

Whether it’s an emergency fund or a retirement account, start saving as soon as possible. Even small amounts add up over time, thanks to the magic of compound interest.

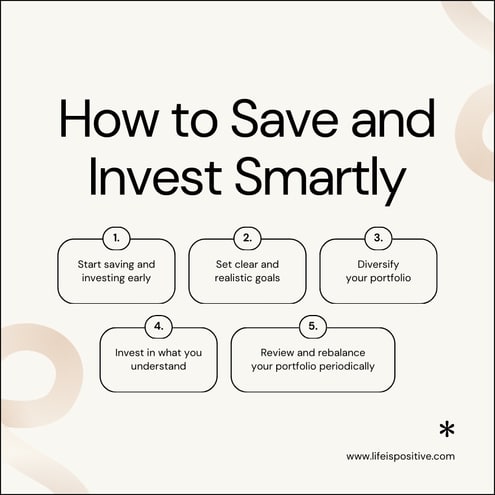

5. Invest Wisely

Don’t let investing intimidate you. Start small with index funds or apps like Acorns or Robinhood. The earlier you start investing, the more time your money has to grow.

Read: Learn How to Crush Your Financial Fear

Why Financial Literacy Matters

Why is being able to say, “I am financially literate,” such a big deal? Because it changes everything.

When you’re financially literate, you feel empowered to make smarter decisions. You stop living paycheck to paycheck, start planning for big goals (like buying a house or traveling the world), and gain peace of mind knowing you’re prepared for the unexpected.

Financial literacy isn’t just about money—it’s about freedom, security, and being in control of your future.

Common Financial Myths to Ignore

On your journey to becoming financially literate, you might encounter some myths that need busting. Let’s set the record straight:

1. Myth: Only Rich People Invest

Truth: Anyone can invest, even with just a few dollars.

2. Myth: You Need a High Income to Save

Truth: Saving isn’t about how much you earn—it’s about how you manage what you have.

3. Myth: Debt is Always Bad

Truth: Not all debt is evil. A mortgage or a student loan can be a smart investment in your future if managed wisely.

Read: Key to Success in Life

How Do I Know If You’re Financially Literate?

By now, you might be wondering how to measure your financial literacy. Here are a few quick self-checks:

- Can you confidently calculate your monthly expenses and income?

- Do you know your credit score and how it impacts your finances?

- Are you saving for short-term goals and long-term ones (like retirement)?

- Do you understand the basics of investing?

If you answered “yes” to most of these, congratulations—you can proudly say, “I am financially literate!”

Keep Building Your Financial Skills

Here’s the deal: financial literacy isn’t a “set it and forget it” kind of thing as life throws curveballs—new job, marriage, buying a house—your financial know-how needs to level up too. But don’t stress; it’s way easier to stay financially savvy when you keep learning and rolling with the changes.

Follow some financial experts, stay curious, and don’t be shy about asking questions. The more you know, the more you’ll rock your money game with confidence.

Final Thoughts on Financially Literate

So, “Am I Financially Literate?” is a big question, right? But don’t sweat it—you don’t need to be a Wall Street whiz to get it together. Financial literacy is all about understanding the basics: managing your money, budgeting, saving, and investing for your future. It’s a journey, not a destination, and it’s totally okay if you’re still figuring it out.

If you’re feeling a little unsure, remember: financial literacy is a skill, not a certificate. You can keep learning, adapting, and growing as your life changes. The more you know, the more you can confidently answer, “Yes, I’m financially literate!”

So, next time you ask yourself, “Am I financially literate?” take a deep breath. Keep learning, stay curious, and give yourself some credit for the progress you’ve made.

You’ve got this—one step at a time, you’ll be owning your money like a pro!

For more empowering content, connect with our vibrant community here ➡️ Social Media