|

Getting your Trinity Audio player ready...

|

Jumping into the stock market can feel overwhelming, especially if you’re just starting out. But don’t worry—we’ve got your back!

Understanding the stock market doesn’t have to be complicated or intimidating.

In this post, we’re breaking down the basics in simple, easy-to-understand terms.

Whether you’re curious about how stocks work, want to know the difference between bulls and bears, or are ready to start investing, this guide is your go-to resource.

By the end, you’ll feel more confident navigating the market and making informed investment decisions.

1. Demystifying the Stock Market

Let’s start with the basics. What exactly is the stock market?

Think of it as a bustling marketplace, but instead of goods, people are buying and selling pieces of companies.

These pieces are known as stocks or shares, and owning them makes you a shareholder in that company.

Transitioning from this analogy, it’s essential to understand that the stock market is a dynamic entity influenced by various factors.

From economic indicators to world events, the stock market reflects the ever-changing global landscape.

The stock market, at its core, is a captivating marketplace where individuals engage not in the trade of goods but in the buying and selling of company shares.

These shares, akin to ownership certificates, are the essence of the market and are commonly referred to as stocks.

Becoming a shareholder grants you a stake in the company’s success and a voice in major decisions.

As you embark on your journey into the stock market, remember that it’s not just a financial arena; it’s a reflection of the ever-evolving of our interconnected world.

Read: Unlock Billionaire Secrets: Books Recommended by Warren Buffet

2. The Players in the Stock Market

Now that we’ve uncovered the lively nature of the stock market, let’s shine a spotlight on the main actors in this financial play.

Meet the brokers, the vital go-betweens linking buyers and sellers. Brokers come in different flavors – traditional firms or online platforms – and serve as the backstage crew, executing stock trades on your behalf.

Transitioning seamlessly, let’s turn our attention to the stars of the show: the companies whose stocks are in the spotlight.

Picture them as the leading characters issuing shares in the market to gather funds.

Now, here’s the exciting part – you, as an investor, can step into the limelight by buying these shares.

It’s like joining the cast and becoming a part-owner of the company, with a front-row seat to its success story.

In this market narrative, brokers are your guides through the twists and turns, while the companies are the tales waiting to unfold.

Together, they create the dynamic plot of the stock market, inviting you to play a significant role in its ongoing drama.

3. The Language of Stocks

Embarking on the stock market journey is a bit like learning a new language – it has its own set of terms and codes.

Let’s start with ‘ticker symbols,’ the special codes for each company’s stocks. For instance, Apple Inc.’s ticker symbol is AAPL. These symbols are like the stock market’s secret handshake, helping you identify and track companies.

Transitioning seamlessly, let’s delve into the ‘bull’ and ‘bear’ markets. Picture a bull charging ahead – that’s a bull market, indicating rising prices and optimism.

Read: Have You Tried These 8 Spiritual Ways to Get Money

On the flip side, imagine a bear hibernating – that’s a bear market, signaling falling prices and pessimism.

These terms act like a compass, giving you direction in the market’s twists and turns. Understanding ticker symbols, bulls, and bears is your stock market language crash course.

It’s like learning the ABCs before diving into reading – essential for navigating this financial landscape with confidence. So, gear up because soon you’ll be speaking the stock market language fluently!

4. Risks and Rewards

Now that you’ve got a handle on stock market jargon, let’s flip the coin and explore the twin realms of risks and rewards.

Investing in stocks is like setting sail on a financial adventure – there’s potential for treasure, but storms may also arise.

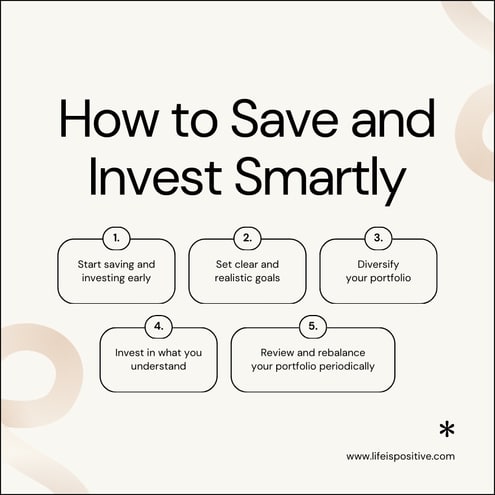

It’s crucial to acknowledge that this journey isn’t a guaranteed ticket to riches, and awareness of potential pitfalls is your compass. Transitioning seamlessly, imagine diversification as your financial safety net.

Picture this: instead of placing all your bets on a single horse, you spread your investments across different sectors and industries. It’s like having multiple baskets for your eggs.

Read: I Will Teach You To Be Rich

If one industry faces a downturn, the others might still be flourishing, balancing out the risks.

Diversification is your shield against the unpredictability of the market, ensuring that a setback in one area doesn’t sink your entire financial ship.

So, as you navigate the seas of investment, remember the golden rule – don’t put all your eggs in one basket!

5. Research and Analysis

Evolving into a savvy investor demands more than a casual glance at the stock market.

Seamlessly moving on from the idea of diversification, let’s unpack the tools in your investor toolkit.

Fundamental analysis is like giving a company a health check – it involves scrutinizing its financial well-being.

On the flip side, technical analysis delves into historical market data, acting as a crystal ball to predict future trends. In this information age, online platforms and financial news outlets are your trusty companions.

Picture them as your GPS in the financial jungle, guiding you through market trends and economic indicators.

Stay plugged into breaking news; it might be the compass pointing you toward potential opportunities or steering you away from unforeseen risks.

Read: 5 Books That Inspired Warren Buffet

Being well-informed is your secret weapon, empowering you to make strategic decisions and navigate the stock market with confidence.

So, in this era of data abundance, make sure to leverage these resources to your advantage!

6. Long-Term vs. Short-Term Investing

As we transition seamlessly from the world of research and analysis, let’s pose a crucial question: are you in it for the long haul or looking for quick wins?

Exploring this divergence opens the door to understanding the disparities between long-term and short-term investing.

For the long-term players, it’s a patient game.

They weather the storms of market fluctuations, aiming for the slow and steady race toward sustained growth over the years.

It’s like planting a tree – the roots grow deep, and the benefits become evident with time.

Conversely, short-term investors are the sprinters of the financial track. They seize on brief market movements, chasing quick profits like a runner aiming for the finish line.

It’s a rapid-paced strategy, requiring swift decisions and an eye for momentary opportunities.

Read: 6 Reasons Why Investing Is Better Than Saving

Crucially, understanding your investment horizon is the linchpin to crafting a strategy that aligns with your financial goals.

Whether you’re in for the marathon or the sprint, knowing your game plan ensures you navigate the twists and turns of the stock market terrain with purpose and precision.

7. Building a Portfolio

Transitioning smoothly from the discussion on investment strategies, let’s talk about building a well-rounded portfolio.

A portfolio is like a carefully curated collection of stocks, bonds, and other assets designed to maximize returns while minimizing risks.

Diversification is the golden rule here as well. Include a mix of stocks from different industries, bonds for stability, and perhaps a sprinkle of riskier assets if you’re feeling adventurous.

Think of your portfolio as a recipe for financial success, with each ingredient contributing to the overall flavor.

Market Orders, Limit Orders, and Stop Orders

Now that you’ve become well-versed in the art of portfolio building, let’s roll up our sleeves and dive into the nitty-gritty of executing trades.

Transitioning seamlessly into this crucial aspect of investing, let’s unpack the three main types of orders: market orders, limit orders, and stop orders.

Think of a market order as akin to writing a blank check to your broker. You’re essentially instructing them to buy or sell a stock at the current market price.

It’s a straightforward, no-frills approach – like grabbing an item off the shelf without haggling over the price. Now, enter limit orders. These give you more control. With a limit order, you set a specific price at which you want to buy or sell.

Read: How to Stop the Flow of Money?

It’s like saying, “I’ll buy this stock, but only if it’s on sale for $X.” This empowers you to secure the deal you desire without overpaying.

Lastly, consider stop orders as your safety net. Picture it as a guardian angel for your investments. You set a predetermined price, and if the stock hits that level, a stop order automatically converts into a market order. It’s a way to minimize losses and protect your hard-earned money in the volatile market arena.

Understanding these order types is akin to wielding different tools in your investment toolbox.

So, as you venture into executing trades, remember that each type serves a distinct purpose, offering you flexibility and control in navigating the market landscape.

8. The Emotional Rollercoaster of Investing

Congratulations on reaching this milestone in your stock market journey! But before you break out the confetti, let’s dive into the emotional side of investing.

Effortlessly transitioning from the intricacies of trade execution, it’s crucial to recognize that the stock market isn’t for the faint of heart.

The market is a wild ride, and it can be as unpredictable as a rollercoaster. Consider risk and return as the yin and yang of investing.

Emotions like fear and greed can sneak in, clouding your judgment and tempting you to make impulsive decisions. It’s like trying to navigate through thick fog – you need a clear head to make the best choices.

Stay disciplined, my friend. Stick to your strategy like a well-worn roadmap. Remember that investing is a marathon, not a sprint.

Read: 10 Lessons From The Psychology Of Money

Patience is your ally, helping you weather the ups and downs that come with the territory. It’s about the long game, steadily building your financial future rather than chasing short-term gains.

So, as you continue your journey, keep your emotions in check, stay disciplined, and embrace the adventure with a steady hand.

The stock market is a marathon with rewards for those who navigate it wisely. Onward!

Final Thoughts: Understanding The Stock Market For Beginners

In this stock market for beginners’ introductory guide (stay tuned for more adventures), we’ve journeyed from the fundamental principles of the stock market to the nuanced art of crafting a diverse portfolio.

The financial realm might appear vast and intricate, but armed with knowledge and a strategic mindset, you’re now well-prepared to navigate the twists and turns of the stock market.

Transitioning seamlessly from the emotional rollercoaster, it’s time to embrace the ongoing journey.

Learn from each experience, savor the adventure, and relish the process of growing your wealth.

Whether you’re a seasoned investor with battle scars or a curious beginner taking the first step, understanding the stock market is an ever-evolving, lifelong learning process.

Read: 10 Signs Money Is Coming Your Way

So, as you embark on this financial expedition, approach it with curiosity, resilience, and a commitment to continuous learning.

May your investment journey be filled with insights, growth, and, above all, financial success and empowerment. Happy investing!

For more empowering content, connect with our vibrant community here ➡️ Social Media.