|

Getting your Trinity Audio player ready...

|

Ever wondered how to develop a wealth-building attitude that takes you closer to financial freedom? It’s not just about the numbers—it’s about shifting your mindset, habits, and approach to money.

The good news? You don’t need a degree in finance to get started. From embracing smart financial strategies to practicing patience with your investments, cultivating a wealth-building attitude is easier than you think.

How Are Assets Distributed Among Different Wealth Levels

Researchers at the Aspen Institute analyzed data from the Federal Reserve’s 2019 Survey of Consumer Finances to see what kinds of assets different households hold based on their wealth levels.

Here’s what they found:

• First wealth decile (0-9.9%): Typically own a car worth around $7,700 and have about $1,250 in checking/savings accounts.

• Second wealth decile (10-19.9%): Usually have a car worth $1,972 and $500 in checking/savings accounts. Interestingly, they have lower asset values than the first decile but higher net worth due to less debt.

• Third wealth decile (20-29.9%): Own a car worth $8,700 and have $1,500 in checking/savings accounts.

• Fourth wealth decile (30-39.9%): Possess a car valued at $12,865, $3,000 in checking/savings accounts, and a primary residence worth $3,500.

• Fifth wealth decile (40-49.9%): Have a car worth $13,000, $3,695 in checking/savings accounts, and a primary residence valued at $95,000.

• Sixth wealth decile (50-59.9%): Typically own a car worth $17,000, have $7,109 in checking/savings accounts, a primary residence worth $164,017, and retirement accounts totaling $4,086.

Read: The Ultimate Guide From Debt to Wealth: Your Road to Success

• Seventh wealth decile (60-69.9%): Possess a car valued at $18,874, $12,000 in checking/savings accounts, a primary residence worth $200,000, and $14,000 in retirement accounts.

• Eighth wealth decile (70-79.9%): Own a car worth $21,000, $14,400 in checking/savings accounts, a primary residence valued at $250,000, and retirement accounts totaling $50,402.

• Ninth wealth decile (80-89.9%): Typically have a car worth $25,600, $32,000 in checking/savings accounts, a primary residence valued at $325,000, retirement accounts totaling $162,248, and $2,500 in securities.

• Tenth wealth decile (90-100%): Own a car worth $34,296, $80,000 in checking/savings accounts, a primary residence valued at $600,000, retirement accounts totaling $600,000, $120,000 in securities, and $30,000 in other property.

These insights show how assets and liabilities shape the financial landscapes of different households.

Read: 10 Sure Ways To Build Wealth You Didn’t Know

How to Start Building Wealth if You Don’t Stand to Inherit It

Building wealth from scratch might seem daunting, especially if you don’t have the advantage of an inheritance.

However, with the right strategies and a disciplined approach, you can pave your own path to financial security.

Here are some practical steps to help you start building wealth.

1. Create a Budget and Stick to It

The first step to building wealth is understanding your finances. Create a detailed budget that tracks your income and expenses.

Categorize your spending into essentials (like rent, utilities, and groceries) and non-essentials (like dining out and entertainment).

This will help you identify areas where you can cut back and save more.

Read: Unlocking Wealth-Building Wisdom In Think And Grow Rich

2. Build an Emergency Fund

An emergency fund is crucial for financial stability. Aim to save at least three to six months’ worth of living expenses.

This fund will act as a safety net in case of unexpected expenses like medical emergencies or job loss.

Having an emergency fund prevents you from dipping into your investments or going into debt when unforeseen costs arise.

3. Pay Off High-Interest Debt

High-interest debt, such as credit card debt, can significantly impede your wealth-building efforts.

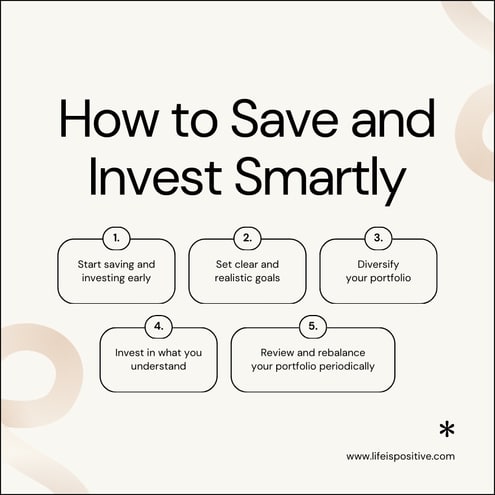

4. Start Investing Early

The power of compound interest means that the earlier you start investing, the more your money can grow.

Consider starting with retirement accounts like a 401(k) or an IRA. Many employers offer matching contributions for 401(k) plans, which is essentially free money.

Even if you start with small amounts, consistent investing can lead to significant growth over time.

Read: Empowerment Money: Your Guide to Financial Freedom

5. Diversify Your Investments

Diversification reduces risk by spreading your investments across different asset classes, such as stocks, bonds, and real estate.

This way, if one investment underperforms, others may perform well, balancing out your portfolio.

Consider low-cost index funds or ETFs for broad market exposure and consult with a financial advisor to tailor an investment strategy to your risk tolerance and goals.

6. Increase Your Income

Boosting your income can accelerate your wealth-building process.

Look for opportunities to advance in your current job, such as asking for a raise or seeking a promotion. Additionally, consider side hustles or freelance work.

The gig economy offers numerous ways to earn extra money, from driving for ride-sharing services to selling handmade crafts online.

7. Automate Your Savings and Investments

Set up automatic transfers to your savings and investment accounts. This way, a portion of your income is saved or invested before you have a chance to spend it.

Automating your finances helps build wealth consistently without having to think about it regularly.

8. Educate Yourself About Personal Finance

Knowledge is power, especially when it comes to money. Educate yourself about personal finance through books, podcasts, and online resources.

Understanding how money works will empower you to make informed decisions and avoid common financial pitfalls.

9. Live Below Your Means

Adopting a frugal lifestyle can significantly enhance your ability to save and invest.

Living below your means doesn’t mean depriving yourself; instead, it means making conscious spending choices.

Focus on what truly adds value to your life and cut back on unnecessary expenses.

Read: 10 Things Millionaires Do Not Spend Money On

10. Set Clear Financial Goals

Having specific financial goals gives you direction and motivation.

Whether it’s buying a home, starting a business, or retiring early, clear goals help you stay focused and disciplined.

Break down your goals into actionable steps and track your progress regularly.

Final Thoughts: Wealth-Building Attitude

Building wealth isn’t just about numbers and financial strategies; it’s also about mindset. Adopting a wealth-building attitude can set the foundation for financial success.

It’s these little celebrations that make the journey enjoyable and help maintain your enthusiasm for your financial goals. Adopting a growth mindset is crucial for building wealth. This means being open to learning, adapting, and continuously improving.

Understand that financial setbacks are not failures but lessons. Use them as stepping stones to refine your strategy and move forward with more knowledge and determination.

Building wealth without an inheritance is entirely possible with strategic planning and disciplined execution.

With the right attitude, you’ll find that building wealth is not just a financial journey but a rewarding personal one as well.

For more empowering content, connect with our vibrant community here ➡️ Social Media.