|

Getting your Trinity Audio player ready...

|

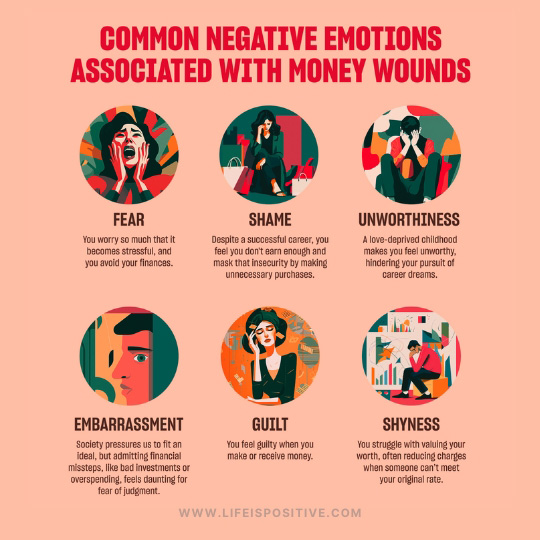

Let’s be real—money is a touchy subject for most of us. Whether we’re avoiding bank statements like they’re horror movies or feeling pangs of guilt after every “treat yourself” splurge, it’s safe to say we’ve all got some money wounds.

These wounds often come with two unwelcome sidekicks: fear and scarcity mindset. Don’t worry, though—you’re not alone, and you’re definitely not doomed to stay stuck in this cycle.

“Don’t tell me what you value, show me your budget, and I’ll tell you what you value.”

Joe Biden

In fact, healing your money wounds starts with one thing: overcoming fear and scarcity mindset. I know that sounds like the tagline of a self-help book, but hear me out.

Fear and scarcity mindset are like those party poopers who show up uninvited and make you think there’s never enough—enough money, enough opportunities, enough anything. Spoiler alert: they’re lying to you.

Ready to kick those toxic thoughts to the curb? Let’s dive into how you can patch up those money wounds, tackle fear and scarcity mindset (told you it’d come up again), and step into a healthier, wealthier relationship with your finances.

Step 1: Recognize the Source of Your Money Wounds

You know how doctors can’t treat an injury without knowing what caused it? Same thing with money wounds.

Whether your scarcity mindset comes from childhood experiences (hello, hand-me-downs, and “we can’t afford that” moments) or a recent financial setback, identifying the root cause is key.

Take a moment to reflect on your money story. Were you taught to save every penny because money was always tight? Or did you grow up thinking money was the root of all evil? These early experiences shape how you think about money today.

Once you identify the culprit, give yourself a little grace. Your money wounds don’t define you—they’re just a part of your journey. And the best part? You’re already taking the first step toward overcoming fear and scarcity mindset just by recognizing where it all started.

Read: Is Your Money Mindset Holding You Back

Step 2: Rewrite Your Money Narrative

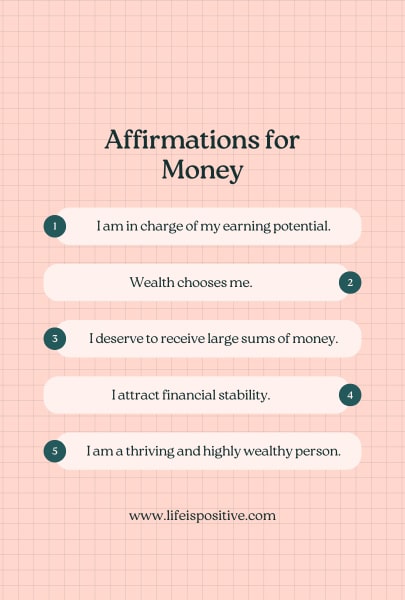

Here’s the deal: the stories you tell yourself about money are powerful. If your internal dialogue sounds like, “I’ll never have enough,” or “I’m just bad with money,” it’s time for a rewrite.

Start by challenging those limiting beliefs. For example, if you believe there’s never enough to go around, flip the script: “There’s more than enough for me and others.” Does it sound cheesy at first? Absolutely. But trust me, your brain listens to what you tell it.

Visualize what financial freedom looks like for you. Maybe it’s paying off debt, saving for a dream vacation, or simply not panicking every time rent is due.

When you shift your focus from a fear and scarcity mindset to possibilities and abundance, you’re giving your brain the green light to find solutions instead of dwelling on problems.

Read: 10 Things You Want To Let Go In Your Life

Step 3: Face Your Financial Fears Head-On

I hate to break it to you, but ignoring your money problems won’t make them go away. The good news? Facing them is way less scary than you think.

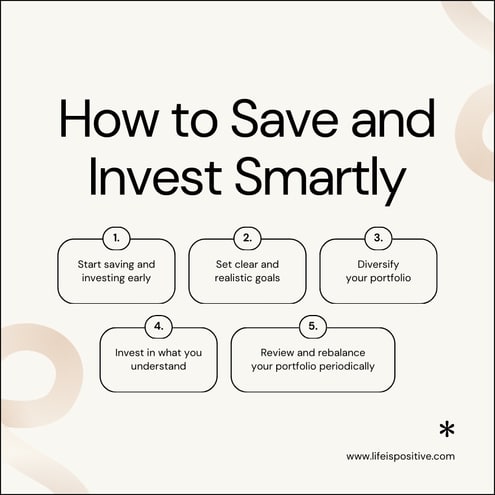

Start small. Take a good, honest look at your finances—your income, expenses, debt, and savings (or lack thereof). Sure, it might sting a little, but it’s like ripping off a Band-Aid: necessary and oddly satisfying once it’s done.

Once you’ve got a clear picture, create a plan to address any problem areas. Whether that’s setting up a budget, negotiating bills, or automating your savings, action is the antidote to fear. And every time you take a step forward, you’re one step closer to overcoming fear and scarcity mindset.

Read: 10 Lessons From The Psychology of Money

Step 4: Cultivate an Abundance Mindset

If fear and scarcity mindset are the villains, an abundance mindset is the superhero we need. But what does that even mean?

An abundance mindset is all about believing there’s enough to go around—enough money, opportunities, and success for everyone.

It’s not about ignoring reality (we’re not manifesting money trees here) but rather shifting your focus from lack to possibility.

Start practicing gratitude for what you already have. Even if your finances aren’t where you want them to be, there’s always something to appreciate—your skills, your health, your morning coffee.

Gratitude has a funny way of making you feel richer, even without a raise.

And don’t forget to celebrate small wins. Paid off a credit card? Found a side hustle? Landed a discount on something you needed? That’s all proof that abundance is already working in your favor.

Step 5: Build Healthy Money Habits

Here’s the truth: you can’t overcome fear and a scarcity mindset without putting in a little effort. Think of it like going to the gym—except this time, it’s your money muscles you’re flexing.

Start by creating a budget that works for you. (And no, budgets don’t have to be boring spreadsheets. Apps make it fun and easy!) Allocate a portion of your income toward savings, debt repayment, and guilt-free spending—yes, guilt-free.

Another game-changer? Automate everything you can. Set up auto-transfers to savings accounts, schedule bill payments, and let your money work for you in the background. The less you have to think about it, the less stressful it becomes.

Read: Learn How to Crush Your Financial Fear

Step 6: Surround Yourself with Positive Money Influences

Ever noticed how being around certain people makes you feel inspired while others leave you drained? The same principle applies to your financial mindset.

Seek out people, podcasts, books, or communities that promote financial empowerment and abundance. Maybe that’s a friend who’s great with money or a personal finance guru whose advice resonates with you.

Avoid falling into comparison traps, though. Your journey is unique, and it’s okay if you’re not where someone else is yet. Remember, the goal is overcoming fear and scarcity mindset—not racing to some imaginary finish line.

Step 7: Be Patient with Yourself

Healing your money wounds is not an overnight process. You’re essentially unlearning years of habits and beliefs, and that takes time.

Celebrate progress, no matter how small. Every time you choose to save instead of a splurge, reframe a negative thought, or stick to your budget, you’re building a healthier relationship with money.

And when setbacks happen (because they will), don’t beat yourself up. Use them as learning experiences and reminders of how far you’ve come.

Read: 8 Spiritual Ways to Get Money

Final Thoughts: Overcoming Fear and Scarcity Mindset

Overcoming fear and scarcity mindset might feel like an uphill battle, but let me tell you—it’s not only achievable, but it’s also one of the most transformative things you can do for yourself.

These mental roadblocks might have been part of your story for years, even decades, but they don’t have to define your future. The effort you invest in healing your money wounds, reframing your narrative, and creating healthy, proactive habits will pay off in ways you can’t even imagine yet.

So, what’s stopping you from taking the first step? Maybe it’s fear, doubt, or even the belief that things will never change—but here’s the secret: you’re in control.

“Price is what you pay; value is what you get.”

Warren Buffett

It could start as small as setting aside a few minutes to create a budget, having that tough but necessary conversation with yourself about your spending habits, or practicing gratitude for what you already have.

Each of these actions might seem tiny on its own, but together, they’re the building blocks of a financial transformation.

And let’s be honest—your wallet deserves some love, and so does your peace of mind. Imagine the relief of knowing exactly where your money is going, the pride of reaching a savings goal, or the sheer joy of feeling abundant, regardless of your bank balance.

These aren’t just pipe dreams; they’re tangible results of overcoming fear and a scarcity mindset.

You’ve already taken the first step by simply acknowledging this challenge and seeking solutions. That’s huge! Now it’s time to keep moving forward, one action at a time.

Believe in yourself, stay consistent, and remember that abundance is out there waiting for you. All you have to do is claim it.

For more empowering content, connect with our vibrant community here ➡️ Social Media