|

Getting your Trinity Audio player ready...

|

Ah, emotional spending – the guilty pleasure that sneaks up on us like a ninja in a shopping mall.

It’s that sudden, mysterious force that compels us to buy a third pair of sneakers (because two just aren’t enough) or that cute coffee mug that winks at us from the store window (even though our cupboard is already a mug metropolis).

But fear not, dear reader, for we’re about to embark on a journey to unravel the secrets of how to stop emotional spending.

So, buckle up and prepare for a wallet-friendly adventure!

Understanding Emotional Spending

Let’s dive into the heart of the matter – understanding what emotional spending really is.

Picture this: it’s been one of those days. The kind where your coffee spills on your new shirt, your computer decides to play hide-and-seek with your important files, and you’re pretty sure if ‘bad days’ had a mascot, you’d be it.

You’re dragging your feet (and your spirits) as low as your phone’s battery at 5 PM.

Then, like a beacon in the storm, you spot it: the shining, enticing lure of a retail store.

Welcome to the world of emotional spending!

Emotional spending is like that friend who’s a terrible influence but incredibly fun to hang out with.

Read: 15 Money Affirmations to Help Make Wise Financial Decisions

It’s when your emotions, feeling all high and mighty, grab the steering wheel from your logical brain, which is probably in the backseat, quietly protesting but ultimately ignored.

You find yourself wandering down the aisles, picking up items with a dreamy, glazed look in your eyes – a new pair of shoes (because the other 20 pairs are so last season), a gadget you’ll probably use once and then forget about, or that expensive skincare product promising eternal youth.

This is your emotions on a shopping spree – no budget too sacred, no impulse too extravagant.

Your heart is playing a game of Monopoly with your wallet, and let’s be honest, it’s not exactly aiming to be a thrifty player.

Your logical brain might be in the background, waving red flags and sounding alarms, but it’s drowned out by the siren song of ‘Buy Now, Regret Later.’

Emotional spending is like eating a giant tub of ice cream in one sitting.

It feels great at the moment – all creamy, dreamy, and full of promise.

But later, just like when you’re staring at the empty tub, wondering where it all went wrong, you’re left with a slightly sick feeling and the realization that maybe, just maybe, it wasn’t the best decision.

Understanding emotional spending is the first step in learning how to stop emotional spending.

It’s about recognizing when you’re in the grips of a retail therapy session that’s more therapy and less retail.

It’s time to take back control, show your emotions, show who’s boss, and remind your wallet that you’re in a committed relationship with responsible spending.

The Emotional Spender’s Playbook:

1. The ‘Retail Therapy’ Myth: Often, we’re led to believe that a little “retail therapy” can cure the blues. But spoiler alert: the relief is temporary, and the bill is permanent.

2. The Joy of the Impulse Buy: It’s that thrill you get from an unplanned purchase. It’s fun, it’s exhilarating, and it’s often followed by a case of buyer’s remorse.

3. Mood Swings at the Cash Register: Our spending habits often mirror our emotional rollercoasters. Happy, sad, bored, or stressed – each emotion has its own shopping bag.

Understanding these patterns is the first step in learning how to stop emotional spending.

Awareness is your new best friend, and it’s time to get acquainted!

Read: Why Money Makes Me Happy: The Surprising Truths

The Impact of Emotional Spending

We’ve all been there – that moment of truth when your bank account gives you the side-eye and asks, “Really? Another pair of shoes?”

Emotional spending might feel like a warm hug for your soul, but it’s often a cold splash of reality for your finances.

Let’s break down the impact:

1. The Great Budget Vanishing Act: Like a magician’s trick, emotional spending can make your carefully planned budget disappear in a puff of smoke. Abracadabra! Where did my savings go?

2. Debt’s Sneaky Ladder: It starts with a small, seemingly innocent purchase. Then another, and another. Before you know it, you’re climbing debt’s sneaky ladder, and it’s a long way down.

3. The Emotional Hangover: The aftermath of emotional spending can be a cocktail of guilt, stress, and financial anxiety. It’s not the most refreshing drink on the menu.

Understanding the impact is pivotal in learning how to stop emotional spending.

It’s about seeing the big picture and realizing that today’s impulsive buy can be tomorrow’s fiscal headache.

Strategies to Stop Emotional Spending

Now that we’ve navigated the treacherous waters of emotional spending let’s steer our ship toward the golden shores of financial responsibility.

Here are five spellbinding strategies on how to stop emotional spending:

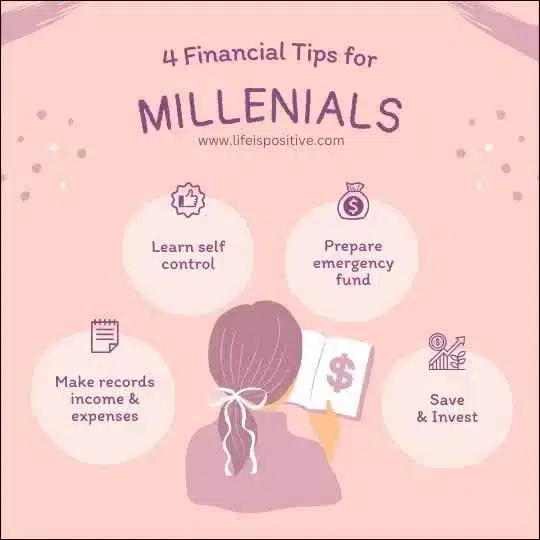

1. The Enchanted Budget: Create a budget that’s not only realistic but also has room for a little fun. It’s like putting your finances on a diet – if it’s too strict, you’ll end up binge shopping.

2. Wait, Is This Love? Before making a purchase, give it a 24-hour thought nap. If you still love it tomorrow, it’s true love. If not, it was just a financial flirt.

3. The Magic of Mindful Spending: Ask yourself, “Do I need this, or do I just want to fill an emotional void?” Mindful spending is like a financial meditation – it brings you peace and keeps your wallet happy.

4. The Spell of Savings Goals: Set exciting savings goals. Whether it’s a vacation or a new gadget, having something to look forward to can magically divert funds from impulse buys.

5. The Potion of Emotional Awareness: Be aware of your emotional triggers. Keeping a spending diary can be an eye-opener, like a financial mirror showing the reflection of your spending soul.

Implementing these strategies is key to learning how to stop emotional spending.

It’s about transforming your financial fears into fiscal fabulousness!

Read: 10 Brain Hacks For Money Saving Mindset

Maintaining Good Financial Habits

So, you’ve mastered the art of how to stop emotional spending.

Congratulations, you’re now a financial wizard in the making!

But as any good wizard knows, the key is not just to learn the spell but also to practice it regularly.

Here are some tips to keep your newfound financial wisdom shining bright:

1. The Daily Budget Brew: Keep a daily check on your finances. A quick glance at your spending habits can be as routine (and as necessary) as your morning coffee.

2. The Savings Spellbook: Regularly update your savings goals. They’re like plot twists in your financial story, keeping things exciting and goal-oriented.

3. The Financial Fitness Routine: Just like physical fitness, financial health requires regular exercise. Review and adjust your budget as needed – it should be as flexible as a yoga instructor.

Remember, maintaining good habits is crucial in learning how to stop emotional spending. It’s not just about the sprint; it’s about the marathon – a journey of continuous financial awareness and improvement.

Final Thoughts

You’re now armed with more tools than a Swiss Army knife, strategies wiser than a council of Yodas, and the kind of financial wisdom that would make Warren Buffett nod in approval.

Think of your mission, if you’re up for it, as turning every chapter of your money story into a work of art.

Imagine your urge to splurge as a big, not-so-scary dragon that used to breathe fire on your savings.

But guess what? You’ve transformed into a super cool hero, all decked out in the brightest armor of budgeting tricks and holding the magic wand of smart saving strategies.

You’re all set to meet that dragon face-to-face and tell it, “Nope, not today, buddy!”

On this adventure, keep in mind that every little choice you make is a step toward your very own fairy-tale ending.

Picture a future where you look at your bank statements and smile instead of diving for cover, and where your savings grow as if by magic.

So, gear up, amazing hero of money smarts!

Embrace this adventure, knowing that each step forward is not just about being steady with your cash but also about building a life filled with financial peace and happiness.

For more empowering content, connect with our vibrant community here ➡️ Social Media.