|

Getting your Trinity Audio player ready...

|

Let’s be honest: dealing with money can feel super overwhelming. Between bills, debts, saving for the future, and trying to have a little fun, it can feel like you’re juggling too many things at once.

If you’re tired of stressing over where your money’s going (and where it should be going), you’re not alone.

Taking control of your finances might sound intimidating, but the truth is, it’s totally doable. You don’t need to be a math genius or live like a hermit to get your finances on track. All it takes is some planning, a few smart habits, and a good checklist to guide you.

So, if you’re ready to stop feeling lost and start taking control of your finances, this ultimate checklist will walk you through step-by-step actions to build a healthier, happier relationship with your money.

1. Start With a Clear Snapshot of Your Finances

You can’t fix what you don’t understand. The first step to taking control of your finances is figuring out exactly where you stand.

Grab a notebook, an app, or a spreadsheet—whatever works best for you—and write down:

- Your total income (salary, side hustle earnings, etc.).

- Your monthly expenses (rent, utilities, groceries, subscriptions, etc.).

- Your debts (credit cards, loans, mortgages).

- Your savings (what’s currently in your bank or investment accounts).

Seeing all your numbers laid out in one place can be a bit shocking at first, but that’s okay. This is your starting point, and it’s only up from here!

Read: How to Crush Your Financial Fear And Anxiety

2. Set Financial Goals That Motivate You

What’s the point of taking control of your finances if you don’t have a goal in mind?

Whether you want to pay off credit card debt, build an emergency fund, or save for a dream vacation, having clear goals will keep you focused.

Start by breaking your goals into two categories:

- Short-term goals (6-12 months): Things like saving $1,000 for emergencies, paying off a small loan, or creating a monthly budget.

- Long-term goals (1-5 years and beyond): Examples include buying a house, saving for retirement, or paying off a major debt.

Make your goals specific and measurable. For example, instead of saying, “I want to save money,” say, “I want to save $5,000 in 12 months by putting away $417 a month.” Now, that’s a goal you can actually work toward.

3. Create a Budget That Works for You

Budgeting doesn’t mean you have to give up everything you love. It just means you’re telling your money where to go instead of wondering where it went.

To start taking control of your finances, build a budget based on your income and expenses. A simple way to break it down is the 50/30/20 rule:

- 50% of your income goes to essentials (rent, bills, groceries).

- 30% goes to wants (fun stuff like dining out, shopping, or entertainment).

- 20% goes to savings and debt repayment.

Use a budgeting app if you’re not a fan of spreadsheets. Apps like Mint or YNAB (You Need a Budget) can track your spending automatically and keep you on track.

Read: Secrets To Manifesting Financial Abundance

4. Build an Emergency Fund

Life loves to throw curveballs. Whether it’s a car repair, a sudden medical expense, or job loss, having an emergency fund is key to taking control of your finances.

An emergency fund acts as your safety net, so you’re not forced to rely on credit cards or loans when the unexpected happens. Aim to save 3-6 months’ worth of living expenses.

If that feels overwhelming, start small. Even saving $500 can make a big difference when you’re in a pinch. Put a little aside each month, and before you know it, you’ll have a solid cushion.

5. Tackle Your Debt Like a Pro

Debt can feel like a dark cloud hanging over you, but don’t worry—you can pay it off with a plan. To get started, make a list of all your debts, including:

- The total amount owed.

- The interest rate on each debt.

- The minimum monthly payment.

From here, you’ve got two main strategies:

- The Debt Snowball Method: Pay off the smallest debts first while making minimum payments on the larger ones. This builds momentum and keeps you motivated.

- The Debt Avalanche Method: Focus on debts with the highest interest rates first to save the most money in the long run.

Whichever method you choose, the key is to stick with it. Paying off debt is a huge step toward taking control of your finances.

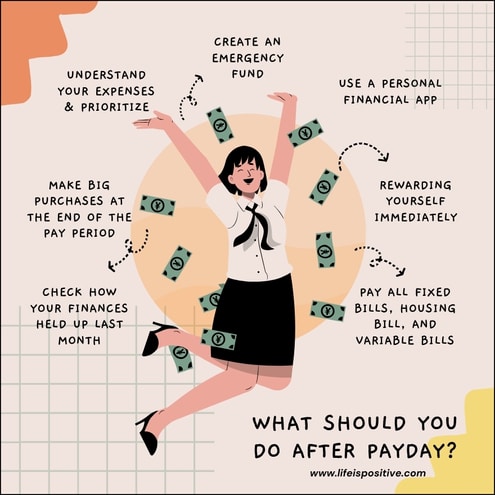

6. Automate Your Savings and Payments

If you struggle to save or pay bills on time, automation is your new best friend. By automating, you’re taking the guesswork out of your finances.

- Set up automatic transfers to your savings account every payday. Even if it’s just $50, consistency is key.

- Automate bill payments so you never miss a due date and avoid late fees.

Automation helps you pay yourself first and keeps your financial goals on track with minimal effort.

7. Track Your Spending and Cut Unnecessary Costs

You might think you know where your money is going, but you’d be surprised how quickly small expenses add up. Taking control of your finances means knowing exactly what you’re spending.

For one month, track every single dollar you spend—yes, even that $3 coffee. Once you see the patterns, you can identify areas to cut back.

Cancel subscriptions you don’t use, cook more at home, or reduce impulse purchases. It’s not about depriving yourself; it’s about being intentional with your money.

Read: How to Stop the Flow of Money?

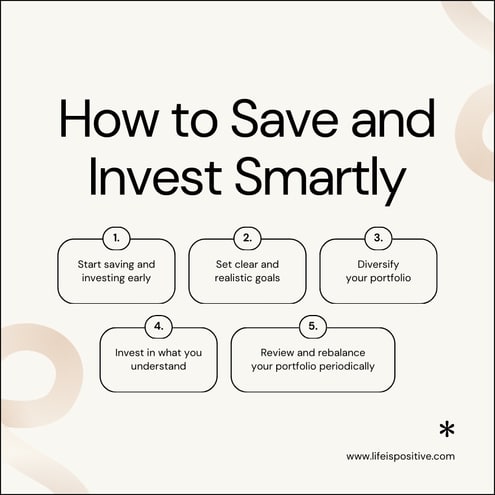

8. Start Investing for Your Future

If saving money is planting seeds, investing is watching those seeds grow into a forest. One of the best ways to take control of your finances in the long term is to invest.

You don’t need a ton of money to start. Look into retirement accounts like a 401(k) or an IRA, where your savings can grow over time. Many apps now allow you to start investing with as little as $5.

The earlier you start, the more time your money has to grow, thanks to compound interest—so don’t wait!

9. Protect Yourself with Insurance

Taking control of your finances isn’t just about saving money—it’s also about protecting what you already have.

Make sure you have the right insurance to cover unexpected losses. This includes health insurance, car insurance, home or renter’s insurance, and life insurance if you have a family to support.

Insurance might feel like an unnecessary expense, but trust me—it’s a lifesaver when things go wrong.

10. Regularly Check Your Progress

Finally, taking control of your finances is an ongoing process. Set a monthly “money date” with yourself to review your budget, track your progress toward your goals, and adjust where needed.

Celebrate the wins, no matter how small. Paid off a credit card? Awesome. Hit a savings milestone? Treat yourself (within budget, of course).

The key is consistency. Regular check-ins keep you focused, motivated, and in control of your financial journey.

Read: How Important is Financial Compatibility In A Relationship

Final Thoughts: Taking Control Of Your Finances

Taking control of your finances doesn’t have to be a scary, overwhelming task. It’s all about building smart habits, making a plan, and sticking with it. Seriously, you don’t need a financial degree to start seeing progress!

With this ultimate checklist in hand, you’ve got everything you need to kickstart your journey to financial freedom. Small steps might seem tiny at first, but trust me, they add up!

Whether you’re putting together your first budget, knocking out debt, or saving for that future dream vacation, every little win counts.

So, what’s holding you back? Start today, take charge of your money, and give yourself the financial peace of mind you’ve been craving. You’ve totally got this!

It’s your money, your rules—now let’s make it work for you.

For more empowering content, connect with our vibrant community here ➡️ Social Media