|

Getting your Trinity Audio player ready...

|

Welcome to the world of love and ledgers, where hearts and wallets meet!

Today, we’re diving into the intriguing realm of financial compatibility in a relationship.

Think of it as a magical blend of love and arithmetic, where your heart’s desires align with the digits in your bank account.

Financial compatibility in a relationship isn’t just about splitting the bill on your first date or deciding who gets the Netflix subscription; it’s about building a future together where money talks don’t lead to slamming doors.

So, prepare as we explore how to ensure your love story doesn’t become a financial thriller.

Let’s discover the secret sauce to blending romance with finance, making sure your love is as rich as your joint savings account!

The Foundation of Love And Money

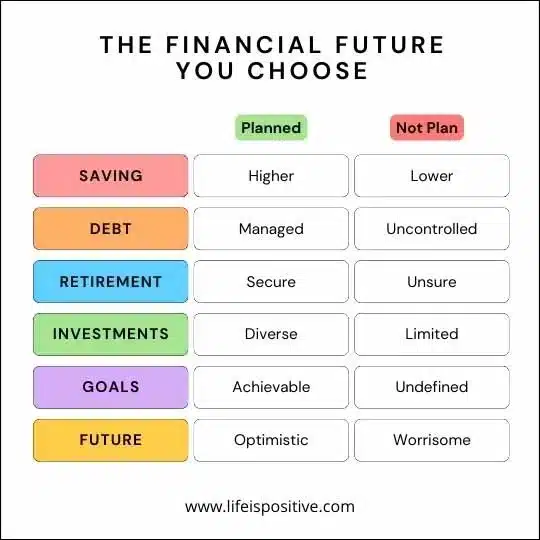

First things first, why is financial compatibility in a relationship so crucial?

It’s simple: money matters are often the root of conflicts.

When two people are on the same page financially, they create a strong foundation for their relationship.

This doesn’t mean you both need to be Warren Buffet, but having similar values and goals regarding money can make a world of difference.

Budgeting – The Romantic Spreadsheet

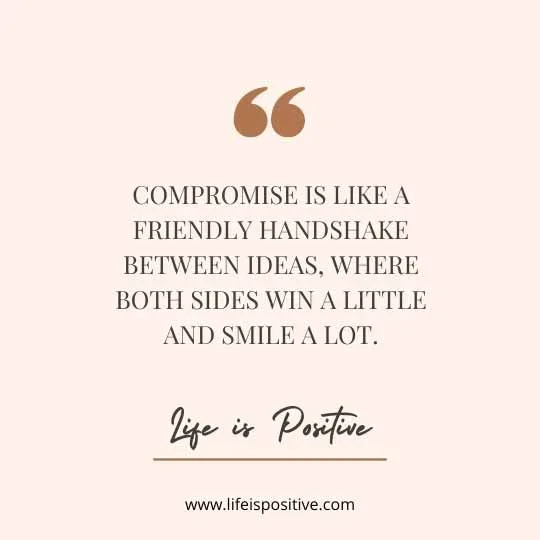

Now, let’s talk budgeting. Yes, spreadsheets can be romantic!

When couples create a budget together, they are not just tracking expenses; they are aligning their dreams and goals.

It’s a collaborative effort where transparency reigns supreme.

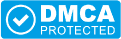

Financial compatibility in a relationship means both partners feel comfortable discussing money, whether it’s saving for a vacation or investing in stocks.

The Debt Dilemma

Debt can be a daunting and stressful aspect of anyone’s life, and it can strain relationships.

But tackling it together with empathy and support can bring you closer and make it less overwhelming.

Remember, financial compatibility in a relationship is about facing challenges and finding solutions together.

So, don’t let debt come between you and your loved ones.

Work together to overcome it and strengthen your bond.

The Savings Sync

Saving money is a crucial part of achieving financial stability and success.

For couples, it provides an excellent opportunity to plan and prepare for a future filled with exciting possibilities.

Whether it’s saving for a dream home, a new car, or building an emergency fund, working together to save requires mutual decision-making and sacrifice.

These are the hallmark traits of true financial compatibility and can strengthen any relationship.

By prioritizing saving as a couple, you can ensure a brighter tomorrow filled with endless possibilities.

The Investment in Each Other

Investing your money is not only about stocks and bonds; it’s also about investing in your relationship.

If you and your partner are financially compatible, you can work together to grow your wealth and achieve your financial goals.

This means respecting each other’s investment choices, understanding each other’s risk tolerance, and committing to building a secure and prosperous future together.

Don’t just build your portfolio; build your relationship too!

The Art of Compromise

It’s no secret that compromise is the key to a successful relationship, and finances are no exception.

When it comes to money matters, the key is to find a balance that satisfies both partners.

Financial compatibility in a relationship is about striking a happy medium between splurging and saving and between indulging in luxury and being practical.

Remember, a healthy financial balance can go a long way in keeping the spark alive in your relationship!

Communication is Currency

Effective communication is the cornerstone of any successful relationship, and when it comes to finances, it becomes even more critical.

By openly discussing your fears, celebrating financial victories, and respecting each other’s perspectives, you can strengthen your financial compatibility.

Remember, it’s not just about numbers; it’s about understanding each other’s values and priorities.

So, start communicating today and build a stronger relationship that will last a lifetime.

Financial Goals – Dreaming Together

Sharing financial goals is a wonderful way for couples to unite and solidify their relationship.

Whether it’s planning a short-term getaway or considering long-term retirement plans, envisioning and establishing realistic targets together demonstrates financial compatibility and mutual trust.

Read: Empowerment Money: Your Guide to Financial Freedom

The Financial Date Night

Revamp your financial conversations!

Transform your routine budget discussions into a fun-filled financial date night.

Discussing finances with your partner while reviewing your budget, tracking your goals, and planning for upcoming expenses can be an unexpectedly romantic experience.

It reinforces the idea that financial compatibility in a relationship is a journey you’re both excited to embark on.

Don’t let money matters become a source of tension.

Make financial date nights an integral part of your relationship to ensure a successful and financially secure future together.

Financial Independence vs. Interdependence

It’s crucial to strike a balance between financial independence and interdependence in a relationship.

Financial compatibility is undoubtedly important, but it should not overshadow the significance of maintaining individual financial identities.

It’s about respecting each other’s financial goals and aspirations and not just pooling resources.

So, support each other’s financial aspirations and create a healthy and secure financial future together.

The Emergency Fund – Your Safety Net

Having an emergency fund is like having a safety net for your finances.

It’s a way to prepare for the unexpected and ensure that you and your partner are ready for whatever life throws your way.

Couples who build this together demonstrate a high level of financial compatibility in their relationship and are able to approach challenges as a team.

Take the first step towards financial security and start building your emergency fund today.

Teaching Each Other – Growing Together

In any relationship, having different levels of financial knowledge is common.

However, learning about finances together can be a unique bonding experience.

You can strengthen your connection as a couple by teaching each other about saving, investing, and budgeting.

Not only that, but financial compatibility in a relationship is known to grow when you learn and grow financially together.

So why not take steps towards a stronger financial future as a team?

Read: Learn How to Crush Your Financial Fear And Anxiety

The Future – Retirement Planning

Planning for retirement is a crucial test of financial compatibility in a relationship.

It’s a time to have meaningful discussions with your partner about your shared future, dreams, and lifestyle choices.

With careful planning and saving, you can create the golden years you’ve always imagined.

So, start planning today for a peaceful and comfortable retirement.

The Joy of Giving

Did you know that financial compatibility in a relationship extends beyond just managing your money?

It also includes your shared values on giving and charity.

Whether contributing to a cause you care about or volunteering your time, aligning your philanthropic goals can bring immense satisfaction and deepen your connection.

Don’t underestimate the power of giving back together- it can truly enhance your relationship in ways you never thought possible.

Navigating Financial Storms Together

Financial challenges are an inevitable part of every relationship. They can either bring a couple closer together or tear them apart.

The key to success is navigating these challenges together as a team.

When faced with adversity, such as job loss, unexpected expenses, or economic downturns, it’s essential to remain united and create a solid game plan.

By offering each other unwavering support and adjusting your financial strategies together, you can turn these challenges into opportunities for growth.

Remember, how you handle these obstacles can be a true measure of your financial compatibility.

Final Thoughts: The Heart of the Matter

When it comes to relationships, financial compatibility is so important.

It’s not just about figuring out how to spend or save money, but it’s about understanding each other’s financial values and building a shared vision of the future.

And let’s be real: managing finances can be stressful, but it’s all about finding joy in doing it together and strengthening your relationship.

Remember, financial compatibility is a journey, not a destination.

Read: Is Your Money Mindset Holding You Back

It takes time and effort, but it’s worth it. So, don’t forget to have fun along the way.

You know you’ve got something special when you can laugh together about that unexpected bill or celebrate saving for that dream vacation.

Nurturing financial compatibility is all about building a future together where love and money coexist.

It’s not just about the numbers; it’s about creating a happy and healthy relationship.

You’ve got this!

For more empowering content, connect with our vibrant community here ➡️ Social Media.