|

Getting your Trinity Audio player ready...

|

Ever dreamed of flipping a magic switch and transforming your financial woes into wows?

Welcome to the club—the “From Debt to Wealth Club,” to be precise!

This isn’t just about moving from owing to owning; it’s about charting a course from the stormy seas of debt to the sunny shores of wealth.

And guess what?

You don’t need a treasure map or a magic wand; just a dash of determination and the right strategies.

In this post, we’ll dive into the smart, actionable steps you can take to embark on your very own journey from debt to wealth—mentioning it not once, not twice, but ten times, because repetition is the mother of learning (and in this case, earning).

Get ready; it’s going to be a ride filled with wisdom, learnings, and, most importantly, loot (of the financial kind).

Understanding Debt

DEBT. That four-letter word that’s as welcome in our lives as a skunk at a lawn party.

It sneaks up on us, quietly amassing in corners of our wallets through credit cards, loans, and those “treat yourself” moments.

Before we know it, we’re in a relationship with debt that’s more clingy than a pair of wet jeans.

But here’s the kicker: understanding your debt is the first step on the journey from debt to wealth.

Dealing with debt is like dealing with that one drawer we all have that won’t close because it’s too full.

It’s overwhelming, yes, but not impossible to tidy. The key? Not to ignore it. Ignoring debt is like pressing snooze on your alarm; it’s only going to make things more chaotic.

So, let’s start by pulling everything out of the drawer, laying it on the bed, and seeing what we’ve got.

Read: Empowerment Money: Your Guide to Financial Freedom

This means listing all your debts, understanding interest rates, and knowing exactly where you stand. As daunting as it might seem, this is where the transition from debt to wealth begins.

It’s about shifting from a mindset of despair to one of proactive debt management. Think of it as your financial awakening—no enlightenment under a Bodhi tree is needed, just a good, hard look at your balance sheets.

Debt Management Strategies

Now that we’ve laid all our debts out in front of us, it’s time to figure out how to bid them farewell.

Here are some foolproof strategies to kickstart your journey from debt to wealth.

1. Budgeting: Your Financial Compass

The first step is crafting a budget that works for you—not one that feels like a straight jacket but rather a comfy pair of jeans.

It’s about knowing where every dollar is going and making sure it’s working for you, not against you.

Tracking your expenses might sound as fun as watching paint dry, but it’s the secret sauce to financial freedom.

It helps you identify where you can cut back (adios, fifth streaming service subscription) and where your money should be going (hello, debt repayment).

2. Debt Repayment Strategies: Snowball vs. Avalanche

Imagine you’re in a snowball fight. Would you tackle the big snowball coming at you first or knock out the smaller ones?

This is the idea behind the snowball and avalanche debt repayment methods.

With the Snowball method, you start small, tackling your mini-debts first.

It’s like picking off the smaller snowballs before they gang up on you, building momentum as you watch each one disappear with a satisfying poof!

Before you know it, you’re rolling downhill with your debt-diminishing snowball growing bigger and your financial worries shrinking smaller.

On the flip side, the Avalanche method is like facing the big, scary snowball head-on.

You aim straight for the debts with the steepest interest rates, knocking them out cold before they accumulate into an unstoppable force.

Read: How to Cultivate a Wealth-Building Attitude

It requires a bit of bravery and some strategic planning, but the payoff is watching the biggest threats to your wallet melt away first.

Both strategies have their perks, but the real trick is choosing the one that keeps you jazzed up on your trek from debt to wealth.

Whether you’re a fan of small victories leading to big celebrations or prefer to take down the giants first, keeping your motivation snowballing is key to winning the financial snowball fight.

Negotiating and Refinancing: The Art of the Deal

Ever thought a simple call with your creditors could lighten your debt load like a helium balloon?

Yep, those financial gatekeepers can actually morph from scary ogres into fairy godmothers (or godfathers) when you approach them with a plan rather than a white flag.

This isn’t about waving the white flag of surrender; it’s more about planning a strategic retreat that benefits everyone.

Calling up your creditors to get lower interest rates on your debts can be as game-changing as swapping your vintage gas-guzzler for a sleek, eco-friendly ride.

And here’s the kicker: creditors can sometimes be as flexible as a Cirque du Soleil performer.

We’re talking lower interest rates, stretched-out repayment schedules, or even a pause on payments (hello, financial breather!).

These little mercies can be the wind beneath your wings, letting you soar over your financial hurdles and land smoothly on your feet, ready to sprint toward your goals.

So, don’t shy away from dialing up those creditors; a friendly chat could just be the secret handshake into the club of financial ease.

The Building Blocks of Wealth

With a solid debt management plan in place, it’s time to focus on building your wealth.

Think of this as constructing your financial fortress—one where you can live comfortably, shielded from the unpredictability of life.

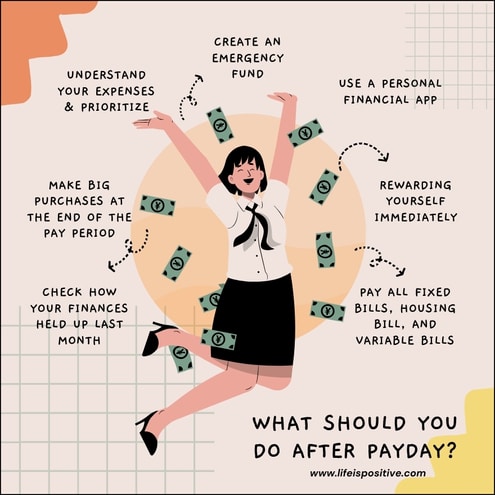

1. Saving: Pay Yourself First

One of the golden rules on the journey from debt to wealth is to pay yourself first.

This means prioritizing savings by setting aside a portion of your income as soon as you receive it, even if it’s just a small amount.

Over time, these savings accumulate and start earning interest, working for you while you sleep.

It’s like planting a money tree in your backyard, except it’s in your bank account, and it actually works.

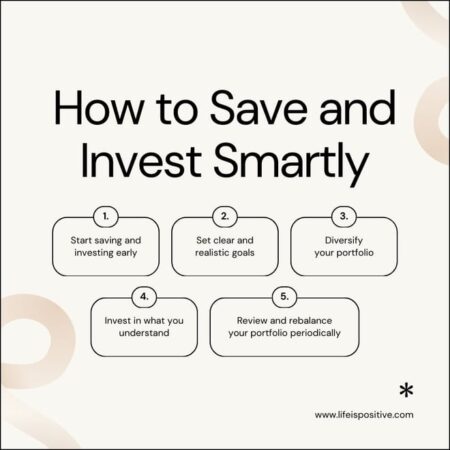

2. Investing: Making Your Money Multiply

If savings are your defensive line in your wealth-building strategy, investing is your offense. It’s about putting your money into stocks, bonds, mutual funds, or retirement accounts to grow over time.

Think of it as sending your dollars to the gym; they come back stronger and more robust. The key here is to start small and learn as you go. Remember, the journey from debt to wealth is a marathon, not a sprint.

Read: Learn How to Crush Your Financial Fear And Anxiety

3. Emergency Fund: Your Financial Safety Net

Last but not least, building an emergency fund is like installing airbags in your car; you hope you never need them, but you’ll be glad they’re there if you do.

This fund helps you avoid falling back into debt when unexpected expenses pop up.

Aim for three to six months’ worth of living expenses, and you’ll be well on your way from debt to wealth with a solid safety net in place.

Read: How to Stop the Flow of Money? 8 Instant Ways

Lifestyle Changes for Sustainable Wealth

Achieving wealth isn’t just about managing money; it’s about adopting a lifestyle that supports your financial goals.

1. Living Below Your Means

Living below your means doesn’t mean you have to skimp on all the joys of life.

It’s about finding balance—enjoying life now while planning for the future.

It’s choosing to cook a gourmet meal at home rather than dining out every night, finding free ways to enjoy your city, and remembering that experiences are often more valuable than possessions.

2. Side Hustles and Passive Income

In today’s gig economy, earning extra cash on the side has never been easier.

Whether it’s freelancing, selling products online, or renting out a spare room, side hustles can provide a significant boost on your journey from debt to wealth.

Similarly, creating sources of passive income, like dividend-yielding stocks or rental properties, can help you earn money with minimal ongoing effort.

3. Wealth Mindset: Focusing on Abundance

Finally, cultivating a wealth mindset is crucial.

This means shifting from a focus on scarcity—what you can’t afford or achieve—to one of abundance, celebrating what you can create and accomplish.

It involves setting clear financial goals, visualizing your success, and taking consistent, positive action toward your dreams.

Final Thoughts: From Debt to Wealth

Embarking on the journey from debt to wealth is an adventure that requires courage, discipline, and a dash of creativity.

It’s about transforming your financial habits, making smart decisions, and staying committed to your goals.

Remember, every step you take, no matter how small, is a step towards a brighter, wealthier future. So, what are you waiting for?

The path from debt to wealth is laid out in front of you, and the best time to start walking it is now. Equip yourself with knowledge, arm yourself with determination, and let’s make that journey from debt to wealth a success.

Here’s to turning those financial dreams into reality, one smart move at a time.

For more empowering content, connect with our vibrant community here ➡️ Social Media.