|

Getting your Trinity Audio player ready...

|

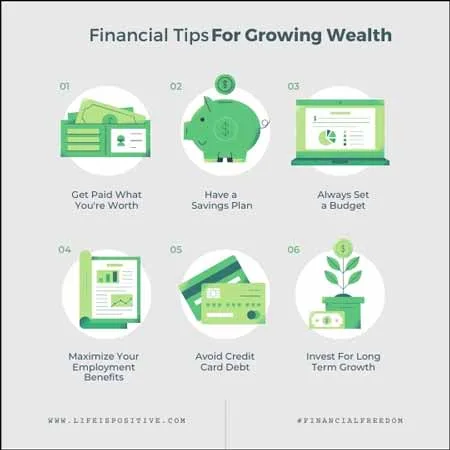

Think building wealth is all about luck or being born into money? Think again! There are plenty of smart, sneaky strategies out there that can seriously boost your bank account—without requiring a trust fund.

In this post, we’re uncovering 10 sure ways to build wealth that might just surprise you.

Whether you’re just starting out or looking to level up your financial game, these tips are your ticket to growing that nest egg. Ready to discover some wealth-building secrets you didn’t know?

The Importance of Building Wealth

Let’s dive into ten effective ways to build wealth that can pave the way for a brighter and more secure tomorrow.

1. Invest Wisely: A Path to Wealth Creation

One of the most powerful tools for ways to build wealth is intelligent investing.

Whether navigating the unpredictable waters of stocks, the stability of real estate, or the diversified allure of mutual funds, the key lies in making informed decisions.

Diversification is the watchword here, spreading your investments across different avenues to mitigate risks.

Staying attuned to market trends is equally crucial, allowing you to capitalize on opportunities and navigate potential challenges.

This strategic approach, rooted in intelligence and adaptability, promises substantial returns over time, propelling you toward lasting financial prosperity.

2. Embrace Entrepreneurship: Turning Passion into Profit

For those with an entrepreneurial spirit, starting a business can be a game-changer.

Identify your passion, assess market needs, and take the plunge. Whether it’s a small-scale venture or a startup, the potential for wealth creation is significant.

This journey, from passion to profit, is not just financially rewarding but emotionally fulfilling.

The fusion of personal enthusiasm and market insight creates a synergy that propels your business endeavors, making the entrepreneurial path a game-changer in the quest for lasting financial success.

Read: Top 10 Growth Ideas for Yourself at Work

3. Smart Savings: A Cornerstone of Wealth Building

The age-old wisdom of saving cannot be overstated. Set aside a portion of your income consistently.

Whether through a 401(k), an IRA, or a high-yield savings account, letting your money work for you is a fundamental step toward financial security.

This strategic step transforms your hard-earned income into a tool that works toward your financial security.

A disciplined commitment to saving shields you from uncertainties and lays the groundwork for a robust financial future, unlocking doors to unprecedented opportunities.

4. Real Estate Riches: Investing in Tangible Assets

Investing in real estate has long been a tried-and-true method of building wealth.

The acquisition of property, be it residential or commercial, emerges as a dual-faceted strategy for building prosperity.

Firstly, it opens the gateway to a steady income stream, with rental properties offering consistent returns.

Secondly, real estate stands as a tangible asset, a physical entity with inherent value that often weathers economic ebbs and flows.

Unlike more volatile investment options, real estate has demonstrated resilience, showcasing its ability to appreciate substantially over time.

This combination of regular income and property value appreciation positions real estate as a robust and enduring pillar in the architecture of wealth building.

It’s not merely an investment; it’s a tangible legacy that stands resilient against the tides of economic change, offering a pathway to sustained financial growth and security.

Read: How to Cultivate a Wealth-Building Attitude

5. Educate Yourself: Knowledge is Financial Power

Learning about money and how it works is really important. Going to workshops, reading books, and keeping up with what’s happening in the markets can help a lot.

Think of it as an investment in yourself, like putting money in a piggy bank. The more you know, the better choices you can make with your money, and that can lead to more success.

Education is an investment in yourself that pays dividends through informed decision-making and financial success.

So, take some time to learn about finances – it’s like giving yourself a superpower for making smart decisions and securing your financial future.

6. Side Hustles: Bolstering Your Income Streams

In the gig economy, opportunities abound for creating additional income streams.

Whether freelancing, consulting, or monetizing a hobby, a side hustle can supplement your primary income and accelerate your journey to financial abundance.

This supplementary income has the power to turbocharge your primary earnings, propelling you faster toward financial abundance.

The beauty of a side hustle lies in its flexibility and the potential to turn your skills or passions into a source of extra cash.

It’s not just about making ends meet; it’s about strategically and creatively enhancing your financial journey toward greater prosperity.

7. Mindful Budgeting: Maximizing Every Dollar

Crafting and adhering to a budget forms the bedrock of building wealth. Start by keeping a close eye on your spending—track every dollar.

Prioritize your needs over wants and allocate your funds strategically, directing them toward your financial objectives.

Approaching budgeting with mindfulness means each dollar has a purpose, working diligently to grow your wealth.

It’s about making intentional choices, understanding where your money goes, and ensuring that it aligns with your long-term financial aspirations.

A well-thought-out budget becomes your financial compass, guiding you toward a future of financial security and success.

So, take control of your finances, make informed decisions, and let your budget be the roadmap to your wealth-building destination.

8. Retirement Planning: Securing Your Golden Years

Planning for retirement isn’t just something you should do; it’s a smart strategy for building wealth over time.

Make it a habit to consistently contribute to your retirement accounts, and if your employer offers a match, take full advantage of it—it’s like getting free money.

Explore different investment options that align with your retirement goals, whether stocks, bonds, or a mix of both.

The key here is to start early—the earlier, the better.

By starting early, you give your money more time to grow, and that can make a significant difference in the size of your retirement savings when the time comes to enjoy those well-deserved golden years.

9. Network for Success: Your Net Worth is Your Network

Creating meaningful connections is like holding a key to doors that lead to unexpected opportunities.

Networking goes beyond just expanding your professional circle; it’s a gateway to collaborations, mentorships, and potentially lucrative business ventures.

The relationships you build can become a source of guidance and support throughout your journey.

In the world of networking, your net worth is not just about money; it’s about the value and strength of your connections.

The more you invest in building a robust network, the more you enhance your potential for success.

So, remember, your net worth is intricately tied to your network—cultivate it wisely, and watch the doors of opportunity swing open.

10. Mindset Matters: Cultivating a Wealth-Building Attitude

Lastly, but with undeniable significance, your mindset plays a pivotal role in your financial journey.

Cultivating a positive attitude toward money isn’t just a platitude; it’s a powerful tool.

Embrace opportunities with enthusiasm and see setbacks as lessons. A mindset geared toward building wealth positions you for success by fostering resilience and adaptability.

It’s not about avoiding challenges but about navigating them with confidence born from a positive perspective.

Nurture a wealth-building mindset, and you’ll find yourself facing challenges and conquering them on your path to lasting financial success. The road to building wealth is diverse and exciting.

From savvy investing to embracing entrepreneurship and fostering a positive mindset, these ten ways to build wealth strategies can set you on the right course.

Remember, building wealth is a journey, not a sprint. Stay committed, stay informed, and watch your financial future flourish. Here’s to your prosperity!

For more empowering content, connect with our vibrant community here ➡️ Social Media.