|

Getting your Trinity Audio player ready...

|

In a world where dollars seem to do all the talking, it’s easy to overlook why emotions matter.

But let’s be real—emotions sneak into every money decision we make, from splurging on that “treat yourself” purchase to stressing over investments.

Why emotions matter isn’t just about keeping our feelings in check; it’s about understanding how they drive our choices.

Money might keep the lights on, but emotions give life its meaning and guide us toward what truly matters. So, in this money-driven world, let’s dive into why emotions matter and how they keep us connected to our real priorities.

Emotions: More Than Just Feelings

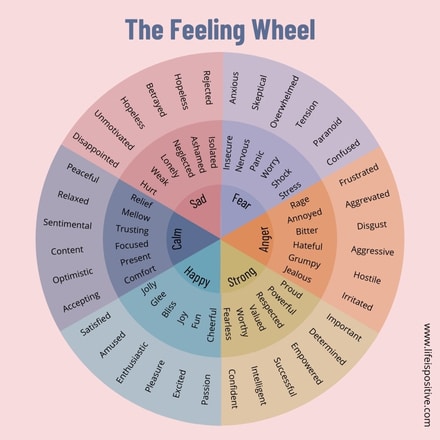

Ever feel like emotions are just these random bursts of happiness, stress, or annoyance? Think again—emotions are way more than just feelings.

They’re like our inner navigation system, guiding us through everything from tough decisions to casual conversations. Imagine trying to handle work, relationships, or even grocery shopping without that emotional compass; we’d be all over the place!

Emotions do more than just tell us how we feel; they reveal what’s really important to us.

That excitement you get about a new idea? Or that frustration when things go sideways? Those aren’t just passing moods—they’re signals helping us understand ourselves better and make smarter choices.

So, emotions: more than just feelings? Absolutely. They’re the behind-the-scenes directors shaping our lives, making sure we’re not just floating through but actually connecting with what matters.

Let’s dig into how these silent guides influence our world in surprising ways.

Read: Why Money Makes Me Happy?

The Impact of Emotions on Financial Well-Being

Ever notice how your mood seems to have a direct line to your wallet? One moment, you’re on cloud nine, and the next, you’re elbows-deep in a cart full of things you didn’t even know you needed.

Yes, emotions play a sneaky role in our financial habits, and trust me—they matter.

Emotions aren’t just about making you laugh or tear up at sappy commercials; they’re behind every impulsive buy, every “just this once” splurge, and every hesitation to invest.

Why do they matter so much? Ignoring the emotional side of money can lead us into patterns that drain our bank accounts—and our peace of mind.

Knowing the “why” behind our spending can help us finally get off that financial rollercoaster.

Emotions and Mental Health

Ever feel like your emotions are on a rollercoaster that forgot to follow the safety guidelines?

One minute, you’re ecstatic because your coffee hit just right; the next, you’re spiraling because your cat didn’t sit with you on the couch. Yes, welcome to the wonderful, chaotic world of emotions and mental health.

In today’s fast-paced, “hustle harder” society, we often find ourselves juggling more moods than a playlist on shuffle.

Mental health isn’t just about therapy couches or breathing exercises (though, shoutout to both); it’s about understanding what makes us tick, finding the balance between Netflix binges and mindfulness, and knowing when to take a mental rain check.

Read: How Money Affects Mental Health

Building Healthy Relationships with Money

Building a healthy relationship with money isn’t just about crunching numbers—it’s about tuning into the feelings that come with every dollar. Fear, gratitude, desire… all these emotions shape how we handle money and reveal more about our journey with it than we might think.

Emotions matter big time in financial well-being. When we start noticing how we feel about money, it shifts from being just a paycheck to something that reflects our inner world.

Money becomes more than a way to pay bills; it’s a tool that can bring peace or fuel our stress, depending on our mindset.

Taking a spiritually mindful approach lets us reshape this relationship, aligning our finances with what truly matters to us. So, let’s dive into this path toward abundance—not just in our wallets but in every corner of life.

Strategies for Managing Emotions in a Money-Driven World

1. Practice Self-Awareness

The first step to understanding why emotions matter in money is cranking up your self-awareness. Start noticing how your mood drives your spending.

Are you diving into a shopping spree every time stress hits? Stashing cash like a squirrel prepping for winter because future finances freak you out?

Spotting these patterns puts you in the driver’s seat, helping you make more balanced choices that aren’t just reactions but intentional moves toward financial peace.

Read: What is Emotional Intelligence

2. Seek Professional Help

If managing the emotional side of money feels like a nonstop rollercoaster, it might be time to bring in the pros—a financial advisor or even a therapist.

These experts can be your co-pilots, helping you untangle the “why” behind your financial feelings and making that love-hate relationship with money way easier to handle.

3. Develop Healthy Coping Mechanisms

Find ways to tackle those emotions without reaching for your credit card. Try activities that lift your mood and keep you grounded, like hitting the gym, meditating, or diving into a hobby you love.

These small habits make a big difference—they help you handle stress and keep you from splurging on impulse. Because, let’s face it, emotions have a big say when it comes to managing your wallet!

4. Set Realistic Goals

Setting realistic financial goals is a surefire way to cut down on money-related stress. Instead of aiming for the moon, break your goals down into bite-sized, achievable steps.

This approach helps you keep emotions in check—because, yes, emotions matter!—stay upbeat and keep that motivation going strong.

Read: How to Crush Your Financial Fear And Anxiety

Final Thoughts: Why Emotions Matter

Emotions matter because they’re like that little voice in your head, nudging you with quiet wisdom every time you make a choice—including with your money.

Emotions aren’t just mood swings; they’re deep messages from within, pointing us to what we truly want and need. When we listen to and understand our emotions, we align with our most authentic selves, paving a path toward real fulfillment.

Embracing our emotions doesn’t mean letting them run the show or brushing them aside. It’s about balancing how we feel with how we act. This way, money becomes more than just cash—it’s a reflection of our journey, helping us build a life of purpose, peace, and abundance.

Emotions make our lives a lot more meaningful and guide us toward becoming our best selves.

Next time you’re caught up in a wave of feelings, take a second to tune in and let them clue you in. Embrace them, learn from them, and see how they shape your path.

For more empowering content, connect with our vibrant community here ➡️ Social Media.